Adani may find it tough to tap foreign funding: Investor GQG

MUMBAI: GQG Partners, a major foreign investor with an $8.1 billion exposure to Adani group companies, has indicated that the US bribery allegations against founder Gautam Adani will limit the conglomerate’s access to international funding.

In its client communication, GQG highlighted that, apart from Adani Green Energy, none of the Adani group companies currently need to raise additional capital. However, if they do require additional funding, “this cloud (referring to the US indictment) will restrict their ability to access foreign capital”.

Following the US indictment, Adani Green scrapped its planned $600-million foreign bond offering. The Florida-based fund notes that Indian banks, particularly state-owned institutions, continue to maintain credit lines to the Adani group without any apparent restrictions.

“There are currently no signs of domestic banks, especially the Indian government owned banks, shutting off credit to the Adani group,” GQG said.

As of Sept 24, domestic banks and institutions had extended nearly Rs 1.1 lakh crore to the conglomerate, representing 42% of its total debt.

GQG emphasised that while Indian govt support remains crucial, “any negative actions by the Indian government could have meaningful implications” on the conglomerate.

It believes the group’s operations will continue even if “individuals receive fines or sanctions”. It cited the example of several global companies – Walmart, Oracle, Siemens, Petrobras, Pfizer, Toyota – that encountered similar governmental actions, noting that such investigations typically extend over years and often result in reduced penalties.

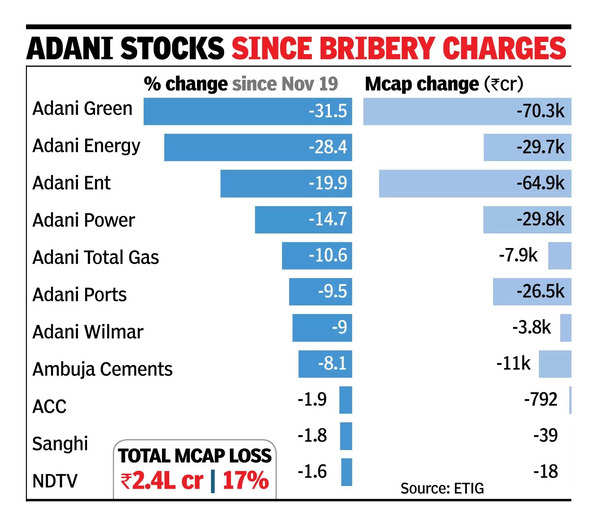

On Nov 20, the US charged “three employees of Adani Green including Gautam Adani” with conspiracy to commit securities fraud and wire fraud in connection to two syndicated loans and two bond offerings involving US investors. The charges relate to alleged bribes paid to Indian government officials between 2020 and 2024 to obtain solar energy supply contracts. Adani Green then sought to raise capital from US investors between 2021 and 2024.