Brands chase Gen Zs who shape spending

MUMBAI: Brands are chasing India’s 377 million Gen Zs – that’s more than the entire US population – as many join the workforce, adding to the cohort’s share of total spends.

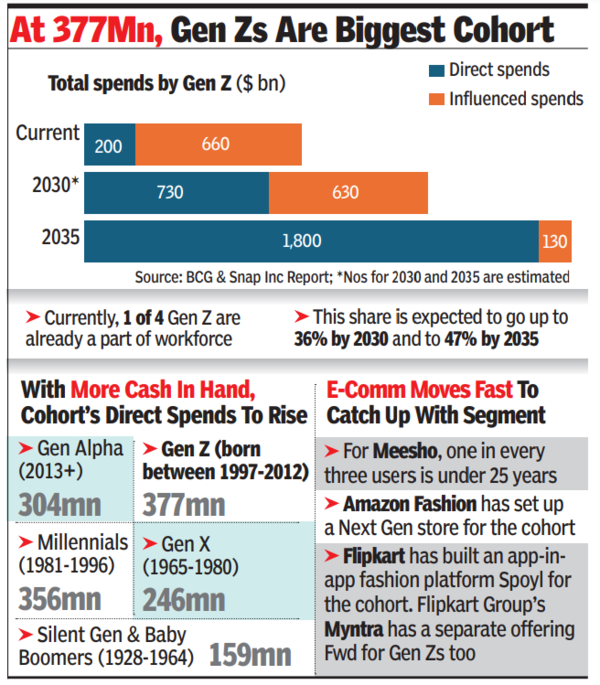

Already, Gen Zs (individuals born between 1997-2012) influence a significant portion of a household’s consumption basket, currently driving 43 per cent or $860 billion of total consumer spends, according to a BCG and Snap Inc report.Of this, about $200 billion comes from their own earnings while $660 billion is influenced spends (by families but the choice of product is influenced by Gen Zs). Estimates suggest that by 2030, about 36 per cent of Gen Zs would be in the workforce, driving $730 billion of direct spends and $1.4 trillion in all – reason enough for brands to take note and strategise.

“The preferences, behaviours and aspirations of Gen Zs are reshaping industries and we are designing our business strategy with them at the core… we are prioritising personalisation, affordability and durability – key factors Gen Z value in their purchases,” Aman Gupta, co-founder and chief marketing officer at BoAt told TOI. He added that the segment is expected to account for a sizable percentage of the brand’s revenues within the next 3-5 years. This will in part be helped by the use of wearable tech in their daily lives.

E-commerce majors Amazon and Flipkart have also been moving fast in their quest for catching the Gen Zs young, setting up separate stores for the cohort within their platforms. While Amazon Fashion has a Next Gen store for Gen Zs, Flipkart has built an app-in-app fashion platform Spoyl for the young shoppers. Flipkart Group’s Myntra has a separate offering Fwd for Gen Zs too.

In fact, Gen Zs being digital natives are the fastest-growing segment in e-commerce. For Meesho, for instance, one in every three users is under the age of 25 years, a company spokesperson said. Zeba Khan, director of fashion & beauty at Amazon India, claimed that the company has seen a three times jump in its Gen Z customer cohort following the store launch. “India’s diverse demographics pose a challenge for fashion brands targeting Gen Z… price sensitivity is a key factor with a significant portion of the population which seeks value for money and affordable options,” Khan said. Nimisha Jain, senior partner and managing director at BCG, said that the cohort’s influence (in terms of consumer spending) cuts across categories ranging from fashion to automobiles and consumer durables.

For Gen Zs, trends score over brands, making the job tougher for companies to keep them hooked. Homegrown wearable brand Noise is investing heavily in technology to elevate the overall experience for Gen Zs, said co-founder Gaurav Khatri. “They are quick to dismiss brands that feel disconnected or overly commercial. This requires us to stay agile, constantly innovating our products. As a matter of fact, they are empowering both the millennials and Gen Alpha with the knowledge of technology and need for lifestyle solutions,” he added.

Titan’s Fastrack is introducing sub-brands and launching targeted campaigns to get more Gen Z shoppers. The brand’s head of marketing Danny Jacob said that its recent product launches like the Fastrack Fleek, Gambit collections and brand Vyb have bolstered the company’s revenues.