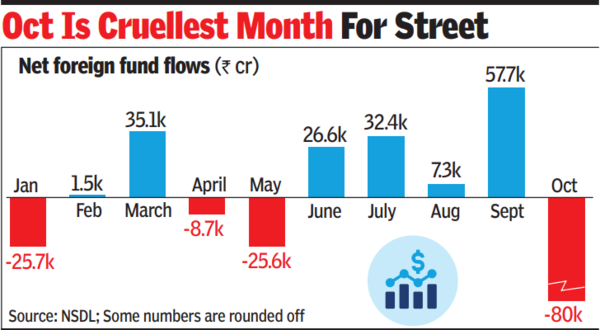

FPI selloff for October hits record 80,000 crore

MUMBAI: With foreign funds taking out over Rs 80,000 crore net so far in the month and amid indications of more selling in the domestic market, leading indices are struggling to hold on at higher levels even on an intraday basis. To add to the bearish sentiment on Dalal Street, global financial sector major Goldman Sachs on Wednesday downgraded India to neutral from overweight, which could lead to further FII selling, market players said.

On Wednesday, the sensex opened at 79,921 points, down about 300 points on the day, rallied to an intraday high of 80,646 points but then as foreign fund selling intensified, it entered the negative territory and closed at 80,082 – down 139 points. A similar pattern was seen in the market in recent days, data from the exchanges showed.

According to Vinod Nair, head of research at Geojit Financial Services, investor sentiment has turned gloomy due to tepid corporate earnings and knee-jerk reaction from foreign funds. Nair pointed out that mid and small-caps stocks, however, are seeing bargain buying following the recent decline. The sustainability of this momentum-driven buying, however, remains uncertain, he said.

So far in Oct, foreign portfolio investors have net sold Indian stocks worth a little more than Rs 80,000 crore.