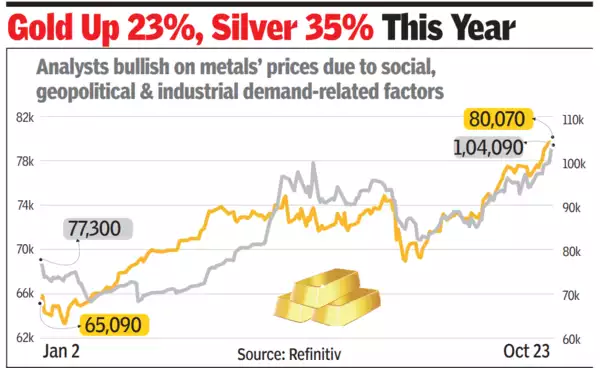

Gold, silver prices dip after hitting life highs

MUMBAI: The price of silver, which mostly plays the second fiddle among precious metals behind gold, cooled a bit on Wednesday after hitting the 6-digit mark for the first time in history the previous day in MCX and spot markets. On Tuesday, the price of silver crossed the Rs 1 lakh-per-kg mark on the Multi Commodity Exchange (MCX) for the first time after its price in the international market rallied nearly 4% in the previous session.

In late Wednesday’s trades on MCX, the Dec futures contracts in silver were trading at Rs 97,100 per kg level.

Analysts remained bullish on the price of silver, as well as gold, because of social, geopolitical and industrial demand-induced factors. The US presidential election early next month is another factor that is adding to uncertainties for markets globally, they said.

The price of gold also witnessed some profit taking on Wednesday after it rallied to a new all-time peak at over Rs 81,000-per-10 gram on Tuesday.

“The (recent) surge in silver prices… is a clear reflection of multiple converging factors,” said Narinder Wadhwa, MD, SKI Capital. “Domestically, India is currently in the midst of its festival and wedding season, which historically generates substantial demand for precious metals like gold and silver. Moreover, the geopolitical climate is contributing to this buoyancy in bullion prices. Bullion, particularly gold and silver, are stable stores of value in times of geopolitical or financial instability,” said Wadhwa, a veteran of the commodities trading space.

The comparative affordability of silver over gold, and industrial demand for the white metal are also helping its northward move, said Jateen Trivedi, VP research analyst (commodity & currency), LKP Securities.

“As retail investors rush to buy silver, spurred by the heavy rise in gold prices, silver appears relatively more affordable” at current prices while gold looks expensive, Trivedi wrote in a recent note.