IT companies gear up to retain business as new deals dry up

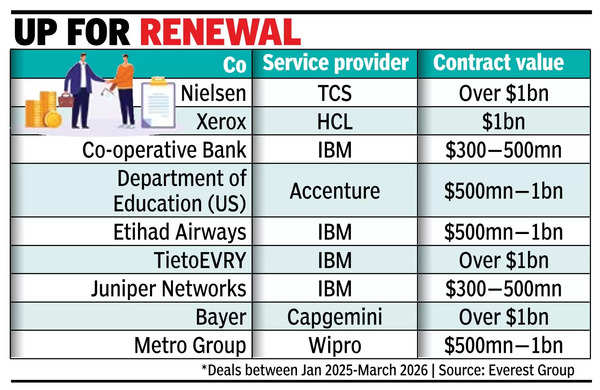

BENGALURU: Following an expansion in large deal pipelines during 2022 and 2023, there is a noticeable decline in new mega IT deals entering the market. However, with a slew of renewals coming up next year, incumbents will defend their business interests and revenue. Although these contracts are up for renewal, it does not automatically indicate a change in service providers. Whilst these contracts may not necessarily transition to new IT players, analysts expect portions of these deals might undergo restructuring with some of the work being moved in-house.

Some of the large deals coming up for renewal in calendar years 2025 and 2026 include TCS, which secured $2.5 billion from audience measurement firm Nielsen. TCS was initially awarded a $1.2 billion, 10-year contract in 2008. Subsequently, the contract value increased to $2.5 billion in 2013, and the contract is expected to expire at end of next year. The SEC filing showed that if Nielsen wishes to renew this agreement following the initial term’s conclusion, they must submit written notification to TCS expressing their renewal intention before Dec 31, 2023.

Should the parties fail to reach a renewal agreement by Dec 31 this year, Nielsen may request termination-expiration assistance services, which TCS must provide according to the agreement. Additionally, Nielsen has the option to extend this agreement’s duration three separate times, each for up to one year, provided Nielsen gives TCS written notice at least six months in advance, the SEC filing showed. Raytheon (DXC), Metro Group (Wipro), and Areva Group (Capgemini) are some of the other deals coming up for renewal next year.

Recently, Xerox entered into fresh agreements with HCLTech and TCS, valued at $590 million for a five-year period and $490 million spanning seven years, respectively. HCLTech’s arrangement encompasses the continuation of its strategic collaboration with Xerox, focusing on AI-powered engineering services and digital process operations. HCLTech will assist the Xerox Global Business Services organisation to enhance crucial business indicators including working capital, device connectivity, sales efficiency, and remote problem-solving effectiveness. However, new deals are a rarity.

“With regard to mega or large deals changing hands, this is possible but unlikely to happen frequently. The risk for the client is very significant, and incumbents work hard to keep the revenue. For instance, the Vanguard-Infosys deal was already significantly restructured and is unlikely to change significantly at this time,” Peter-Bendor Samuel, CEO of IT research and advisory Everest Group, said.

When asked whether IT firms are at risk of losing out parts of the business due to in-sourcing, Yugal Joshi, partner at Everest Group, said GCCs are creating some headwinds for service providers, especially for those who do not serve GCC as a strategic client segment. “Most service providers stay away from BOT (build, operate, transfer) models for GCCs, as that does not give long-term revenue visibility. Therefore, consulting companies such as the Big Four may end up becoming a strong choice for such engagements.”

Joshi cited many examples, including National Australia Bank reducing share of outsourced IT workforce from 70% in 2018 to 37% by 2023. When asked about fewer large deals, Bendor-Samuel said belief is that US is headed for a soft landing and, so, radical cost savings that drive the large deal market is less intense.