Make for India: FMCG companies think & design desi | India News

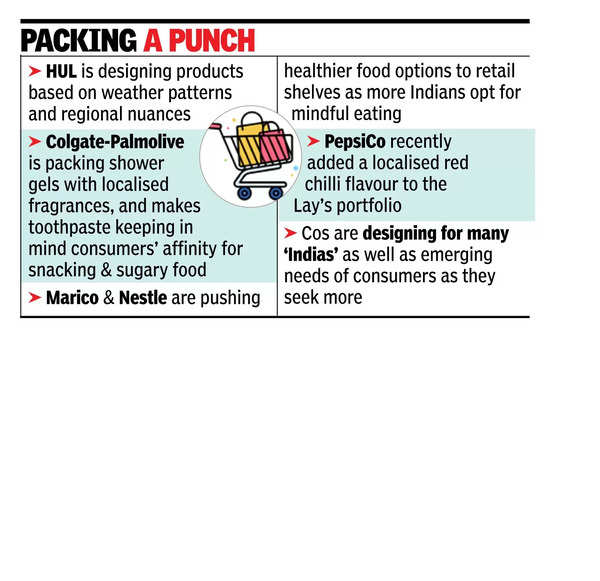

MUMBAI: Inside Hindustan Unilever‘s headquarters in Mumbai, a section of the research and development team is busy studying consumer trends and drawing up ideas on the next set of products that the company should push into retail shelves to cater to changing consumer tastes. As Indians become discerning and selective in terms of the products they consume, FMCG firms are increasingly focusing on local nuances and “designing for India”.

At HUL, which is relying heavily on technology to bring products to the market faster, the way the firm processes products for different regions has also undergone a change. “In South, the Red Label tea we sell is a finer blend. In North, the tea is more daaneydar (grainier). The way we process the tea is also quite different,” Vibhav Sanzgiri, executive director (R&D) at HUL, said. India’s varying weather patterns, diverse tastes and cultures have necessitated companies to design for the Indian palate. “We are looking at health, taste, wellness, fragrance and even packaging,” said Sanzgiri, who leads a team of over 800 scientists across HUL’s three R&D centres in India.

Besides, consumers today are willing to pay a premium for differentiated products, enabling firms to pack more in a product. Colgate-Palmolive, for instance, has introduced arginine-based toothpaste in the Indian market considering consumers’ affinity for snacking and sugary food. “While designing and developing products for Indian consumers, we need to build on the various nuances of Indian taste preferences and ensure what is the target consumer group. Given our population size, we have to innovate for all age groups and specialised needs as all of them are quite substantial,” Swati Agarwal, executive vice-president (IGTC) at Colgate-Palmolive India, said. It is also packing its shower gels with localised fragrances.

For Marico, building for India is all about offering healthier options without compromising on the taste. To that end, the company has been pushing honey, millets, soya chunks and oodles into the market under the Saffola brand. The offerings come after its oats, infused with Indianised flavours, gained acceptance among consumers. “Indian consumer preferences are continually evolving. There is a growing demand for healthier and sustainable FMCG products,” said Dr Shilpa Vora, chief R&D officer. A recent study by venture capital firm Fireside Ventures showed that urban Indian consumers are willing to pay upto a 15% premium across food categories (covers five segments including staples, functional beverages and healthy snacks) and up to 30% for healthier snacking, functional drinks and ready-to-eat/ready-to-cook items.

Nestle India has tapped into this premiumisation trend to launch over 140 new products in the market over the past eight years. Some of these like the Maggi oats-millets and KitKat Dessert Delight Strawberry were later taken to other global markets. “Everybody is aspiring for the best product suited for them and this trend will continue. Indians today travel much more, they have more global exposure, the influence on consumers is unconstrained and we might even leapfrog certain global trends,” Sanzgiri said.

Recently, PepsiCo India added a localised red chilli flavour variant in its Lay’s portfolio to appeal to desi nuances. “As a nation of many Indias, Lay’s recognises the importance of tailoring its products to cater to diverse preferences,” Soumya Rathor, category lead (potato chips) at PepsiCo India, said.