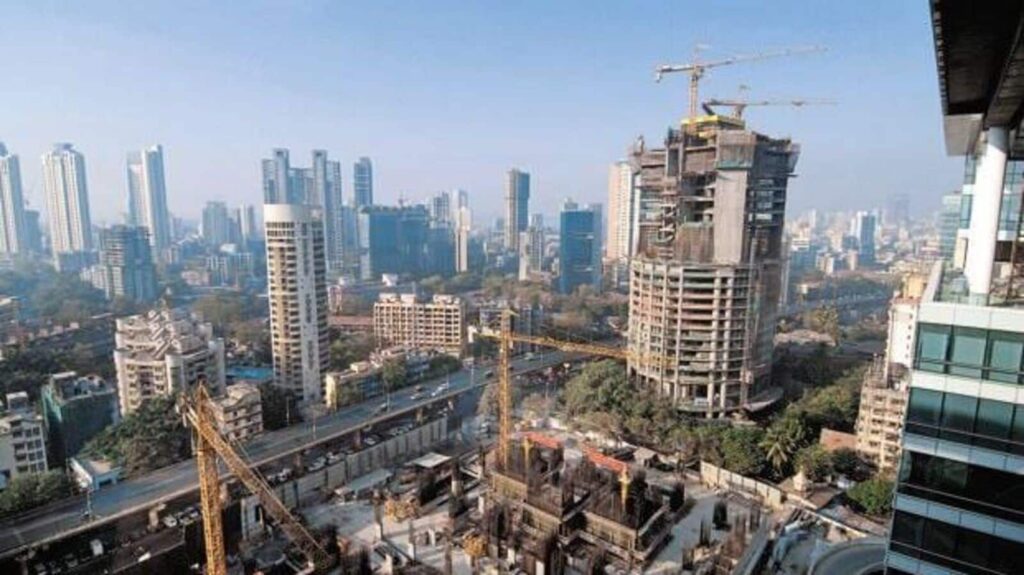

Mint Primer | Urban slowdown: Will home prices come down, too?

What sort of price rise has home sales seen?

Between 2016 and 2020, there was no rise in home prices due to the slowdown. It was only after the pandemic that sales picked up, as did prices. Home prices have been rising continuously across all the seven major metros in recent years. Average price per sq. ft has risen by around 40.5% since 2021, says Anarock Property Consultants. Among the top markets, National Capital Region (NCR), Bengaluru, and Hyderabad have seen the biggest increase in prices. Tier-II cities have also seen increased project launches and sustained price rise. Goa as a second home market has seen the sharpest increase.

What has led to this price escalation?

India’s real estate sector is in the fourth year of a boom cycle. This momentum has led to consecutive peaks in sales and accelerated project launches, pushing up prices. With home sales increasing by 49% between 2022 and 2024, inventory overhang came down. Developers gained confidence to launch high-end properties, as the luxury market rebounded. As in any boom cycle, nobody wants to build affordable homes. So, more project launches are happening in the premium or luxury categories, escalating property prices. An increase in land, construction and labour costs has also impacted property prices.

Why has NCR seen the highest ticket size growth?

Multiple factors, including renewed investor confidence, homebuyer interest, the Dwarka Expressway and the planned Jewar airport have led to a rise in prices. The boost in home sales has also prompted developers to launch expensive homes. Gurugram is the new luxury capital; Noida, Greater Noida, and Ghaziabad have also seen significant price movement.

So, will prices moderate now?

The ongoing residential bull run is expected to continue, which means prices will keep rising. With enough homebuyers, and the return of investors, sales have not seen a major dip despite the rise in prices. Liases Foras Research forecasts that until sales are impacted, prices will keep rising for the next two years. However, in some cases, builders will first increase prices, and then offer easy payment schemes. Some markets, of course, will see higher price appreciation than others, depending on sales and demand.

Has this impacted affordability?

Affordability has declined since 2022 due to prices and stagnant interest rates. Property advisory JLL India indicates that most cities may see improved affordability by 2025, except for Delhi-NCR and Bengaluru. An anticipated interest rate cut, moderate price growth and sustained income rise could spur sales over the next 12–18 months. By 2025, Mumbai and Pune will reach optimal affordability levels, meaning more households will be eligible for home loans. Kolkata will be the most affordable real estate market.