More brands hop on 10-min delivery ride

MUMBAI: 10-minute shopping is the new consumer favourite. As more people take to rapid deliveries and the idea becomes mainstream, brands are queuing up for quick commerce platforms to cash in on the trend.

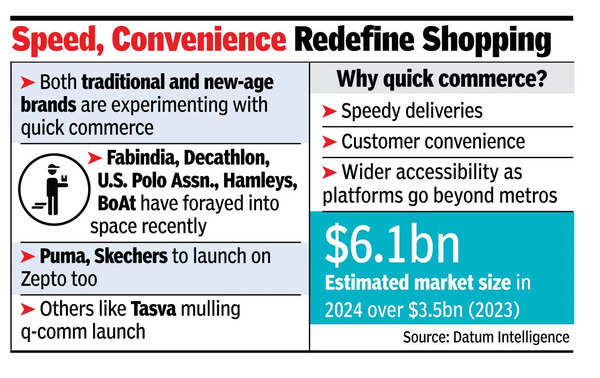

In recent weeks and months, brands like Fabindia, Decathlon, Adidas, U.S. Polo Assn., Hamleys and BoAt have joined the quick commerce rush, listing their products on Blinkit, Swiggy Instamart and Zepto.Several others like Puma (some of its products can be found on other platforms) and Skechers are gearing up for a launch on Zepto, Astha Gupta, head of apparel and lifestyle at the company, told TOI. “This is just the beginning of a larger trend where speed and convenience redefine how people shop in India,” she said.

With quick commerce firms expanding beyond metros and the market scope widening, it’s hard for brands to overlook the opportunity. Many companies are mulling adding quick commerce as part of their product distribution strategy. Tasva, the Indian menswear brand by Aditya Birla Fashion and Retail and designer Tarun Tahiliani, for instance, is planning a pilot launch of its casual wear collection on quick commerce platforms, sources said.

For brands which often have a tough time finding the right real estate for their stores, including quick commerce in the mix allows them to reach more consumers and faster, widening accessibility for their products. Over the past few months, quick commerce platforms have also forayed into smaller cities like Nashik, Varanasi, Udaipur, Haridwar and Bathinda. Brands may, however, just be experimenting with quick commerce platforms before taking any long-term partnership bets, analysts said. “It’s more of an experimentation phase right now for brands. We don’t see massive traction for brands like Adidas and Fabindia because they are more to do with apparel, and reverse logistics and return issues are very high in apparel. More than 25-30% of the products which are bought online are returned. What exactly gets success and what does not, that we have to wait and watch. Segments like grocery, staples, beauty and personal care, gifting, mobile accessories will continue to be high frequency categories for quick commerce platforms,” Karan Taurani, vice president at Elara Capital, said.

The rapid rise of quick commerce seems to have had a bearing on organised retail chains. The stock price of Avenue Supermarts, which owns DMart, fell nearly 9% on Monday after its Q2 performance disappointed the street, with brokerages pointing at increasing competition from quick commerce players in large metros as a reason. Quick commerce – initially started as an instant grocery delivery service – has over the years expanded to non-grocery categories, with companies delivering a host of items including charging cables, home appliances, travel bags, fans, air coolers during peak summers and occasionally even iPhones.

Besides, companies in the space have also been able to market festivities well and tap into festive demand by delivering consumers all related products in minutes. Events like Navratari, Ganesh Chaturthi, Rakhi, among others, have become big drivers of sales for the platforms. Analysts at Datum Intelligence estimate the quick commerce sector to surpass $6 billion in sales in 2024 from $3.5 billion a year ago.

As quick commerce firms widen the selection of items, they are also equipping themselves by launching easy returns and exchanges. Blinkit has already enabled this service in the big metros.