Reliance Industries Q2 net drops 3% on weaker refining margin

Mumbai: Reliance Industries, India’s largest company in terms of market value, posted a 3% drop in quarterly profit on Monday, hurt by weak refining margins. Profit stood at Rs 19,323 crore in Q2 FY25, in line with analysts’ expectations. Revenue was stable at nearly Rs 2.4 lakh crore, benefiting from the strength of the oil-to-chemicals (O2C) and oil & gas businesses as well as its fast-growing digital services (Jio) businesses.

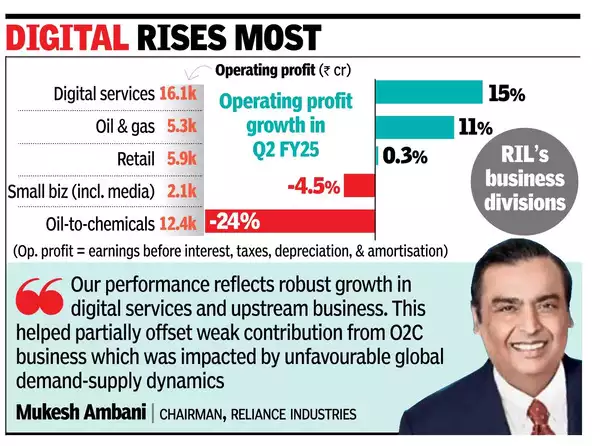

Operating profit, a yardstick for underlying business performance, fell 3.1% to Rs 41,809 crore. Expenses climbed by a marginal 1.4% to about Rs 2.2 lakh crore.

Operating profit of the O2C business decreased 24% to Rs 12,413 crore due to sharp decline in product margins. Fuel cracks declined nearly 50% as did petrochemicals, with muted global demand in a well-supplied market. Fuel cracks refers to cracking or breaking crude oil into different components like jet fuel, gasoline, and kerosene. “The performance reflects growth in digital services and upstream (oil & gas) business. This helped partially offset weak contribution from the O2C business which was impacted by unfavourable global demand-supply dynamics,” company chairman and MD Mukesh Ambani said.

Operating profit of digital (Jio) climbed 15% to Rs 16,139 crore due to better subscriber mix, scaling up of business and revision in telecom tariffs. Jio’s average revenue per user – a key metric that influences income – stood at Rs 195 in Q2, up 7.4%. ARPU is the total revenue of the telecom operator divided by the number of users on its network. Launched in 2016, Jio has about 479 million customers as of Sept 30, 2024 and saw data and voice traffic growth of 24% and 6% on its network respectively. Jio continues to be the largest 5G operator outside of China with 148 million subscribers, it said.